The Federal Solar Investment Tax Credit, or ITC, first saw the light of day back in 2005, thanks to an energy policy act. In our quest to utilize more eco-friendly sources of power, solar panels have gained in popularity. So much so, that the ITC's expiration date was moved from 2007 to 2022!

If you've been considering solar panels, here's everything you need to know about the ITC!

What Is The ITC?

It's an incentive for homeowners to go solar. When you have the solar panel system that you purchased installed onto your home, you'll be able to take advantage of a federal tax credit as a thank you for investing in renewable energy.

In 2020, homeowners who own their solar panels will be able to deduct 26 percent of the cost of installing the system from their federal taxes. That cost includes things like permits, installation, and equipment.

Let's say that you end up spending $15,000 on your system. That means that you'll be able to deduct $3,900 from your federal taxes!

Am I Eligible For The Solar Tax Credit?

As this is a tax credit, you would have to owe taxes to make use of the ITC - don't get the ITC confused with a refund. That being said, since most people do owe taxes, it's very likely you'll be eligible.

Another big factor in eligibility comes down to ownership. If you own your solar panel system, you're probably eligible. Unfortunately, if you lease panels, you won't get to put the ITC to use, as any incentives or credits would be saved for the company that owns the panels.

The solar tax credit applies to both residential systems and commercial ones, so don't hesitate to start comparing solar panel quotes!

Can I Claim The Credit More Than Once?

Provided you are adding new solar panels to your system, or installing another entire system, yes, you can then again claim the tax credit based on those additional costs.

If you're unsure as to what you can claim, it's best to team up with a tax professional. That way you can ensure you're getting the maximum benefit amount!

How Will The Solar Tax Credit Change Over Time?

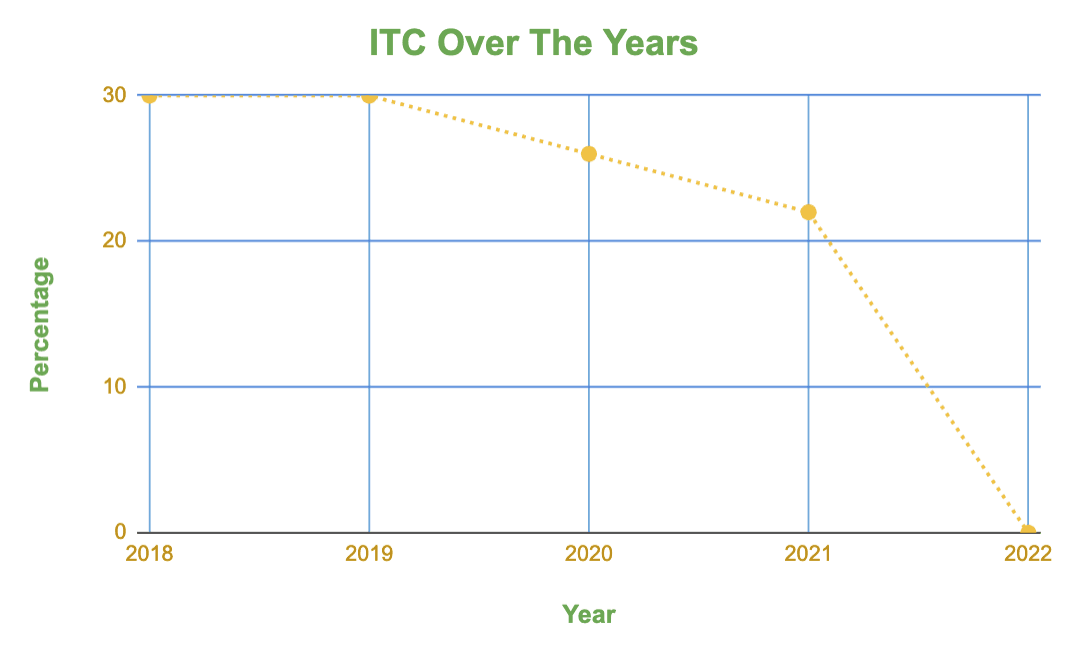

As it currently stands, the federal solar tax credit is set to expire in 2022. In terms of residential customers, they'll get 26 percent through 2020.

That number then drops to 22 percent through 2021.

Unless there is another extension, homeowners will not get to make use of the credit at all in 2022, but those with panels on their commercial properties can. That credit in 2022 will be for 10 percent.

Don't Miss Out On Solar Energy

What's a key takeaway? Time is of the essence! If you're entertaining the idea of solar panels, don't wait to start comparing installation quotes. Another takeaway? A renewable energy system is more affordable than you think!

There are numerous incentives and rebates that homeowners get to put to use, all of which help mitigate the upfront cost of a system. Add to that the amount you can save every month on your electric bill and the generous federal solar tax credit, and it's easy to see why so many homeowners are opting for solar power!